News, Blog and Socials.

Follow for more on our

social media channels.

How to Advertise in Airports Internationally (Heathrow vs. Dubai, etc)

Airport advertising offers a premium, captive, and affluent audience, but moving beyond a single country increases complexity. Successfully executing a campaign across Heathrow, JFK, or Dubai requires coordinating between different media operators, creative specifications, and cultural regulations. This roadmap outlines the value of the channel and who to contact to ensure global consistency.

How to Advertise in Public Transport

Millions of people move through UK cities daily, creating predictable corridors of attention. Unlike digital ads that can be skipped, transport advertising is woven into the urban fabric. Whether targeting a specific bus route in Manchester or a Tube station in London, this guide explains the commercial power of the commute and who to contact to ensure consistency.

How to Advertise in Universities

University campuses are self-contained ecosystems where students live, study, and socialise within a defined geography. For brands, this creates a rare opportunity to reach a concentrated audience at a formative stage of independence. This guide explains how to penetrate these walled gardens and who to contact to make it happen.

How to Advertise on Petrol Pumps

People constantly scroll past online adverts, however, petrol pumps offer something rare. You get a stationary audience with nothing else to do. This guide explains how businesses can use petrol pump advertising to grab attention and drive sales.

How to advertise in Lifts and Office Buildings

Commercial office buildings offer a completely distraction-free space to reach high-value professionals. This guide explains how brands can use lift screens and lobby displays to capture attention during the daily commute, turning the corporate nine to five routine into a highly targeted advertising channel.

How to Advertise in Hospitals and GP Surgeries

Healthcare environments offer one of the most trusted and highly engaged spaces for any brand. This guide explains how businesses of all sizes can use hospital and GP surgery media to reach people during long waiting periods and build strong brand authority in the heart of the community.

How to Advertise in Gyms

Health and fitness venues offer one of the most engaged and high-frequency advertising environments available. This guide explores how to leverage the "active dwell time" of the gym floor to build deep brand connections. We discuss the importance of segmenting audiences by gym type, the power of washroom panels for gender-specific targeting, and why partnering with an integrated agency is essential to navigate the complex landscape of national chains and independent clubs.

How to Advertise in Convenience Stores (Co-op, Londis, etc)

The local convenience store has evolved from a simple corner shop into a sophisticated retail media environment. For advertisers, it offers high-frequency exposure to consumers in their local community. This guide examines how to harness the power of convenience retail, exploring the effectiveness of shopping cart ads, the impact of experiential sampling, and why partnering with an integrated agency is the key to executing a seamless campaign across a fragmented network of thousands of stores.

How to Advertise in Universities / How to Advertise in Student Campus

The university campus is a unique marketing environment where habits are formed and brand loyalties are established. This guide explores how to effectively advertise to the student market by moving beyond simple posters to a full-spectrum media takeover. We discuss the power of roadside and transport advertising to capture the student commute, the impact of guerrilla tactics like invisible ads and ad bikes, and how sampling networks like Dig-in get your product directly into dorm rooms. We also explain why partnering with an integrated agency is the only way to execute this complex mix across the fragmented UK higher education landscape.

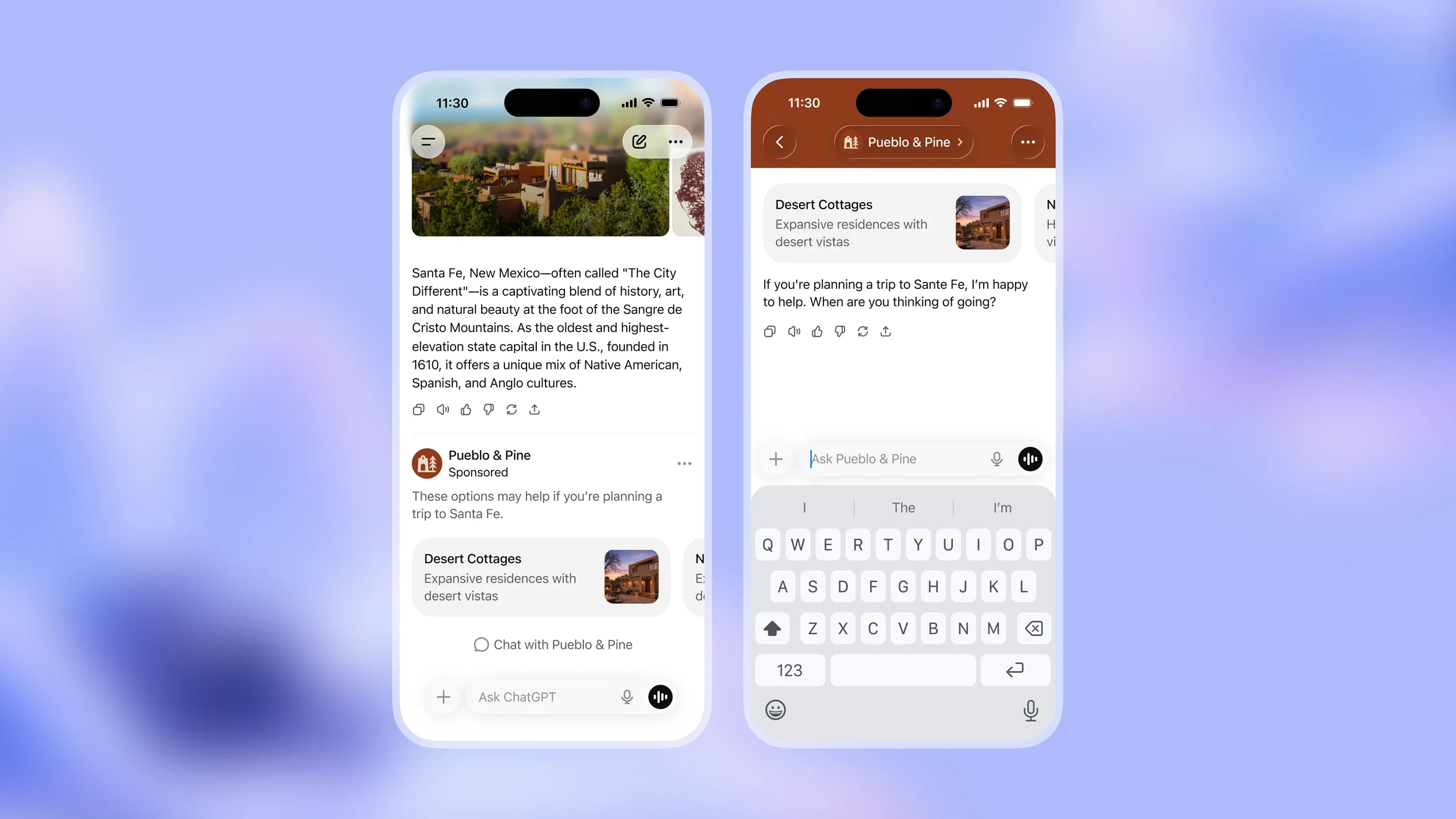

How ChatGPT Ads Work

ChatGPT Ads introduce a new way for brands to appear at moments of genuine intent. Instead of interrupting users with banners or feeds, advertising is placed within conversational environments where people are actively searching for answers, ideas, and recommendations. This shift moves advertising away from attention grabbing and towards relevance, trust, and usefulness. For marketers, it opens the door to engaging audiences at the point of decision, inside one of the fastest growing AI platforms in the world.

Explore All of Our Content.

Get in touch!